reverse tax calculator bc

An online reverse sales tax Remove Sales tax calculation for residents of canadian territories and provinces with high accuracy. That means that your net pay will be 38554 per year or 3213 per month.

Reverse GST Calculator.

. Reverse Sales Tax Formula Calculates the canada reverse sales taxes HST GST and PST Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST. Type of supply learn about what supplies are taxable or not. Reverse GSTPST Calculator After Tax Amount Best 5-Year Variable Mortgage Rates in Canada nesto 190 Get This Rate Andy Hill 195 Get This Rate BMO 265 Promotional Rate TD 270 Get This Rate CIBC 274 RBC 275 Fixed Rate Variable Rate Check Canada Mortgage Rates From 40 Lenders Sales Taxes Across Canada for 1000.

Current Provincial Sales Tax PST rates are. This calculator is for you. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax.

Provinces and Territories with GST. Just set it to the GST Only setting and enter in the after-tax dollar amount that you want to reverse. The rate you will charge depends on different factors see.

The reverse sales tax calculator exactly as you see it above is 100 free for you to use. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes. Gross Salary Calculator Need to start with an employees net after-tax pay and work your way back to gross pay.

GSTHST provincial rates table. Calculator formula Here is how the total is calculated before sales tax. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Reverse Calculator Purchase Price Including Net GST. Bc sales tax gst pst. The British Columbia Income Tax Salary Calculator is updated 202223 tax year.

Reverse Québec sales tax calculator 2021. You can get a free online reverse sales tax calculator for your website and you dont even have to download the reverse sales tax calculator - you can just copy and paste. Formula for reverse calculating HST in Ontario.

2020 2021 Canadian. Alberta British Columbia 5 British Columbia 12 Manitoba 5 Manitoba 12 New-Brunswick Newfoundland and Labrador 15 Northwest Territories Nova Scotia Nunavut Ontario Prince Edward Island Québec GST 5 Québec QST 9975 Québec QSTGST 14975 Saskatchewan 6 Saskatchewan 11 Yukon. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time.

Net Income Taxable Income - Canadian Tax - British Columbia Tax - CPP - EI. This simple PST calculator will help to calculate PST or reverse PST. If You are looking to calculate your salary in a different province in Canada you can select an alternate province here.

The rate you will charge depends on different factors see. Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns no later than July 15 2022. 162 83201 to 227 091.

If you make 52000 a year living in the region of British Columbia Canada you will be taxed 13446. Determine taxable income by deducting any pre-tax contributions to benefits Taxable income refers to the income on which the government imposes taxes. Now I want to calculate the tax from the total cost.

98 90101 to 120 094. Reverse GST Calculator. Your taxable income is.

Your average tax rate is 259 and your marginal tax rate is 338. It is very easy to use it. The BC homebuyer tax calculator application is a free service offered by the British Columbia Real Estate Association.

Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for each market sector and location. The information used to make the tax and exemption calculations is accurate as of January 30 2019. Reverse GSTHST Calculator Total after taxes Province Best 5-Year Variable Mortgage Rates in Canada nesto 180 Get This Rate Butler Mortgage 184 Get This Rate CIBC 259 BMO 265 Promotional Rate RBC 270 TD 270 Get This Rate Fixed Rate Variable Rate Check Canada Mortgage Rates From 40 Lenders Find your GSTHST rebate for a new home.

If youre looking for a reverse GST-only calculator the above is a great tool to use. TurboTax Free customers are entitled to a payment of 999. The reverse sales tax calculator exactly as you see it above is 100 free for you to use.

This calculator should not be considered a substitute for professional accounting or legal advice. Alberta British Columbia BC Manitoba Northwest Territory Nunavut Quebec Saskatchewan Yukon GST Tax Rate. To calculate your BC net income follow the step-by-step guide outlined below.

In 1994 the government introduced the First-Time Home Buyers Program and. For more information about British Columbia and Canada tax rates brackets visit the Personal Income Tax Rates page of. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC.

HSTQSTPST variable rates Amount without. GSTHST calculator Use this calculator to find out the amount of tax that applies to sales in Canada. Overview of sales tax in Canada.

Originally called the Property Purchase Tax the PPT was first introduced in 1987 as a wealth tax to discourage speculation and cost 1 of the first 200000 and 2 of the remainder although 95 of home purchases did not qualify for the tax at the time as they were below the 200000 mark. The net income of an individual is the take-home pay that an employee receives after paying taxes and deductions. From 1st of July 2019 sales tax in Manitoba decreased from.

If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. 227 09101 or more. GSTHST provincial rates table The following table provides the GST and HST provincial rates since July 1 2010.

120 09401 to 162 832.

Pin By Deepak Kumar On Proprietorship Registration Mutuals Funds Investing Best Investments

How Much Money Is Taken Of My Paycheck Part Time Job At A Grocery Market Chain In Ontario Canada Quora

Https Www Comparethetiger Com Mloan Mortgageloansreversemortgagesfinancemortgagesfhamortgages Reverse Refinance Loans Reverse Mortgage Real Estate Marketing

Understanding Uae Vat Reverse Charge Mechanism Exceldatapro Vat In Uae Uae Reverse

Ten Rupees 800000 Serial Number Note Xf Condition For Sale Price Rs 300 Debt Consolidation Loans Credit Card Debt Relief Reverse Mortgage

Calculate The Sales Taxes In Canada Gst Pst Hst For 2022 Credit Finance

Adding A Reverse Mortgage To Your Nest Egg Strategy Marketwatch Reverse Mortgage Mortgage Payment Calculator Mortgage Refinance Calculator

Art Cards Art Ink Print Fine Art Print And Design Services

Neoprene Lunch Bag By Art Of Lunch Artist Monika Strigel Germany And Art Of Liv 39 N Have Partnered In A Neoprene Lunch Bag Designer Lunch Bags Lunch Tote

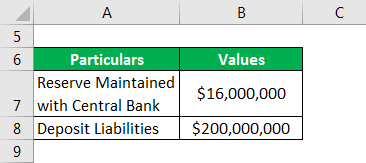

Reserve Ratio Formula Calculator Example With Excel Template

Reverse Hst Calculator Hstcalculator Ca

Vat Refund For Expo 2020 Dubai In 2022 Expo 2020 Expo Vat In Uae

Behind On Taxes Home Equity Solutions

Newfoundland And Labrador Sales Tax Hst Calculator 2022 Wowa Ca

Neoprene Lunch Bag By Art Of Lunch Artist Monika Strigel Germany And Art Of Liv 39 N Have Partnered In A Neoprene Lunch Bag Designer Lunch Bags Lunch Tote

Terminal Value Formula Of Perpetuity Growth And Exit Multiple Method

Hector Alvarez 802 432 8672 On Instagram It Is Time To Buy Rates Continue Dropping So Take Advantage And Save B Reverse Mortgage Being A Landlord Mortgage